RBI Hikes Repo Rate by 35 bps to 6.25%

Category:Uncategorized

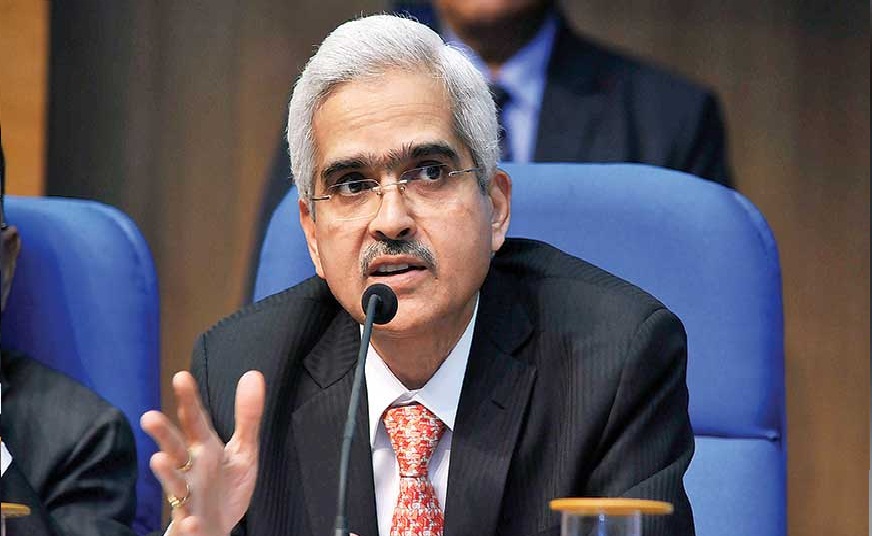

Reserve Bank of India: The Monetary Policy Committee (MPC), comprising three RBI members and three external members, decided by a majority vote to raise the key lending rate, or repo rate, to 6.25%.

The Reserve Bank of India’s key repo rate hike by 35 basis points (bps) on Wednesday was widely expected for a fifth straight hike, signaling its battle against high inflation is not over yet.

The Monetary Policy Committee (MPC), comprising three RBI members and three external members, decided by a majority vote to raise the key lending rate, or repo rate, to 6.25%.

Five of the six members voted in favor of the decision.

The Standing Deposit Facility rate and the Marginal Standing Facility rate were also raised by a similar amount of 6.00% and 6.50%, respectively.

“The MPC hiked rates by 35bps as expected while maintaining an ‘exit accommodative’ stance. We expect the MPC’s focus to remain cautious as uncertainty over inflation eases. We are long we see rate hikes 25 basis points before the time is halved.”