How to Register on the New Income Tax Portal for Filing ITR

Category:Income Tax Portal,ITR Registration ProcessTo file your Income Tax Return (ITR) using the government’s new Income Tax Filing Portal, you will need to register yourself and open an account with the portal. Therefore, if you are filing an ITR for the first time, you must first register on the new Income Tax Filing Portal to file your return.

Below is a step-by-step guide on how to register and open an account with the new income tax filing website.

Additional Conditions for Registration on New Income Tax Portal

Before starting registration on the new Income Tax Portal, one must ensure the following:

a) Individuals should have a valid and active PAN

b) mobile phone number

c) Email ID

Step-by-step guide to register on the new income tax portal

Here is a step by step guide on how to register on the new income tax portal

Step 1: Go to the new Income Tax Portal: www.incometax.gov.in

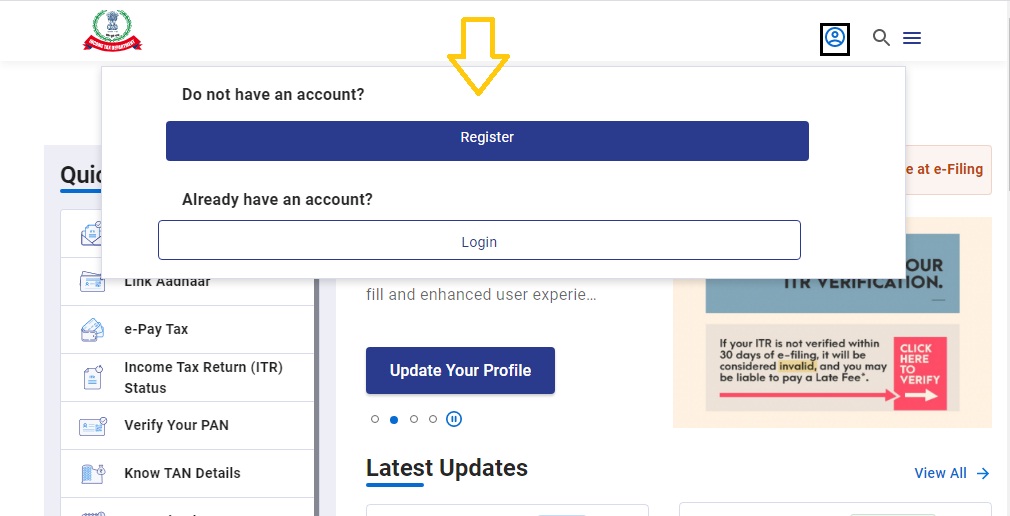

Step 2: On the new portal, click Register

Step 3: Make sure “Taxpayer” is selected. Enter your PAN and click Verify. If your PAN is already registered or deactivated, you will receive an error message. Confirmation is required if you want to register as an “individual taxpayer”. After successfully verifying the PAN, click Continue.

Step 4: Next, you need to enter basic details such as Last Name, First Name, Middle Name, Date of Birth (as per PAN), Gender and Residence Status (Resident/Non-Resident). Once you’ve filled in these details, click ‘Continue’.

Step 5: In the next tab, you will need to provide your contact details i.e. primary mobile number and primary email id. You’ll also need to choose whether the primary mobile phone number and email address are yours or someone else’s. You will also need to enter your residential correspondence address.

Step 6: A separate One Time Password (OTP) will be sent to your mobile number and email ID. Remember, these OTPs are only valid for 15 minutes. After entering the OTP, click Continue.

Step 7: You need to verify all the details that you have entered in the previous tab. If there is any mistake in the details you have mentioned, you will get the option to edit it in the last step. After verifying the details, click Confirm.

Step 8: Now enter your desired password and enter the same password as confirmation password. Remember, your password should include the following:

a) Must be a minimum of 8 characters and a maximum of 14 characters.

b) must contain uppercase and lowercase letters

c) must have at least one number

d) must be special characters

You will also be required to enter personal information of up to 25 characters. This message will be shown to you every time you log into your account on the new Income Tax Portal.

This will help you make sure you’re logging into the original website and not a fake one.

After entering your message, click Register. You will be successfully registered on the new Income Tax Portal.

You can now log in to file your tax return and/or use other tax related services.