What is GST portal? Accessing GST Portal – Complete Guide

Category:GST PortalGST Portal is the official website of Government of India under Goods and Service Tax. Website hosted at www.gst.gov.in.

GST Portal is a single website for all GST related activities in India. As such, it includes GST registration and completing the login process where you can access your agreed GST details. Using this portal, users can register their taxes, submit returns, make payments and request refunds.

Apart from this, taxpayers can see many other options on the dashboard after logging on www.gst.gov.in. Let us have a introduce at the features available on the GST Portal below. The website can be used by millions of users at the same time.

Visit the GST Portal now

You can also search by typing www.gst.gov.in in google and you will find it on the first page. The main function of GST Online Portal is to act as an online system for carrying out all online activities for Goods and Services Tax.

Front View of GST Portal

Features of the GST Portal

The front menu of GST Portal can be used to perform various activities without logging into GST Portal. Taxpayers need GST login credentials to perform basic operations on the GST Portal. These are the basic functions:

1) Home : From anywhere in the portal, you can click the Home button to return to the home page, which is gst.gov.in.

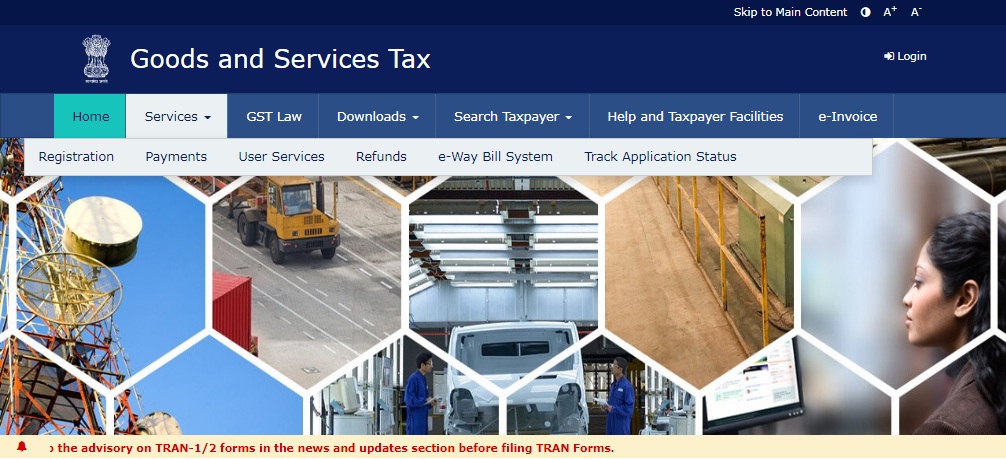

2) Services : The Services tab provides services related To:

GST Registration, GST payments, User services GST Refund related Status.

The registration menu also has three submenus:

a) New Registration: The New Registration link allows individuals to apply for GST registration online. One can fill in the details and submit to get a GST registration certificate. You can learn about the GST online registration process here

b) Track Application Status: This link helps an individual to track his/her application submitted on GST Portal. It lets the individual know if his/her application was successfully processed or held due to any issues.

c) Filing Clarification Request: Anyone can visit this link to seek clarification on any filing matter.

The payment menu has two sublinks:

a) Generate Invoice: With the help of this link, an invoice for GST payment can be generated online without logging into the GST Portal.

b) Track Payment Status: You can track the status of your payment by clicking on this link. It will show if the GST payment has been transferred from the bank.

User Services has five sublinks:

a) Holiday List: It will also provide center and state wise holiday list.

b) Complaints/Complaints: Taxpayers can lodge complaints regarding application, payment and electronic ledger issues. Beyond that, anyone can file a complaint against both registered and unregistered persons.

c) Find a GST Practitioner (GSTP): You can find a GST Practitioner near your area.

d) Find Business Address: This link will help you find the nearest GST jurisdiction address for your business.

e) Generate User ID for Advance Ruling: This link is for new registrations applying for Advance Ruling.

3) Consumption Tax Law

GST Legal Links provides information on all official notices, circulars, orders and more.

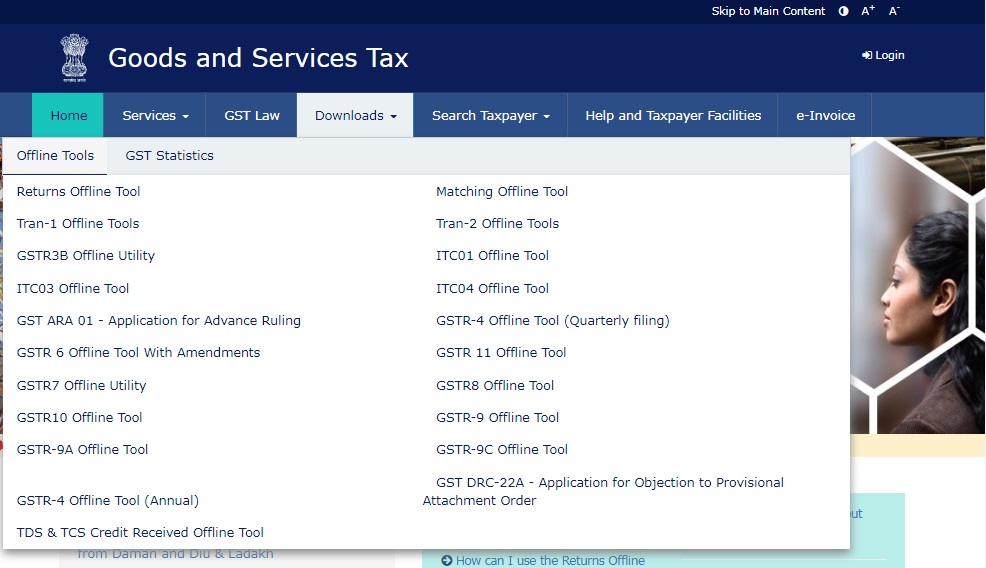

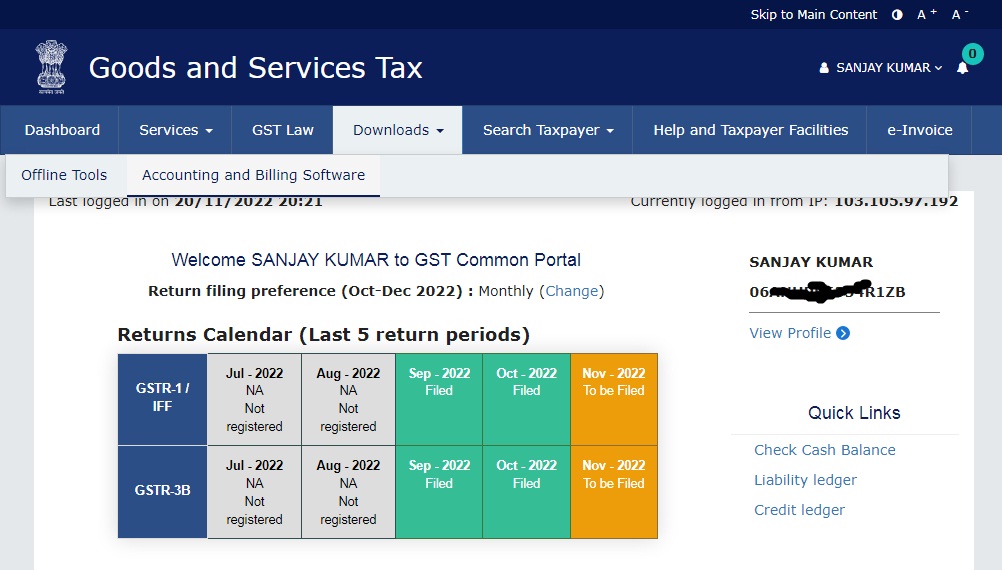

4) Download

The download section provides offline tools for download for filing GST returns, ITC forms and many other statutory reports.

Currently available offline tools are Returns Offline Tool, TRAN-1 Offline Tool, TRAN-2 Offline Tool and GSTR3B Offline Utility.

Apart from this, other offline tools are available like ITC01 Offline Tool, ITC03 Offline Tool, ITC04 Offline Tool, GST ARA 01 – Advance Ruling Application, GSTR 4 Offline Tool, GSTR 6 Offline Tool with Amendments and GSTR 11 Offline Tool .

Likewise, annual filing preparation tools such as GSTR 9, GSTR 9A and GSTR 9C are now available at www.gst.gov.in.

5) Query taxpayers

Any taxpayer can search by entering details like GST number and all details will flash on the screen of that particular taxpayer

6) Support:

This section provides assistance related to registration, returns, refunds and various other activities on the GST Portal.

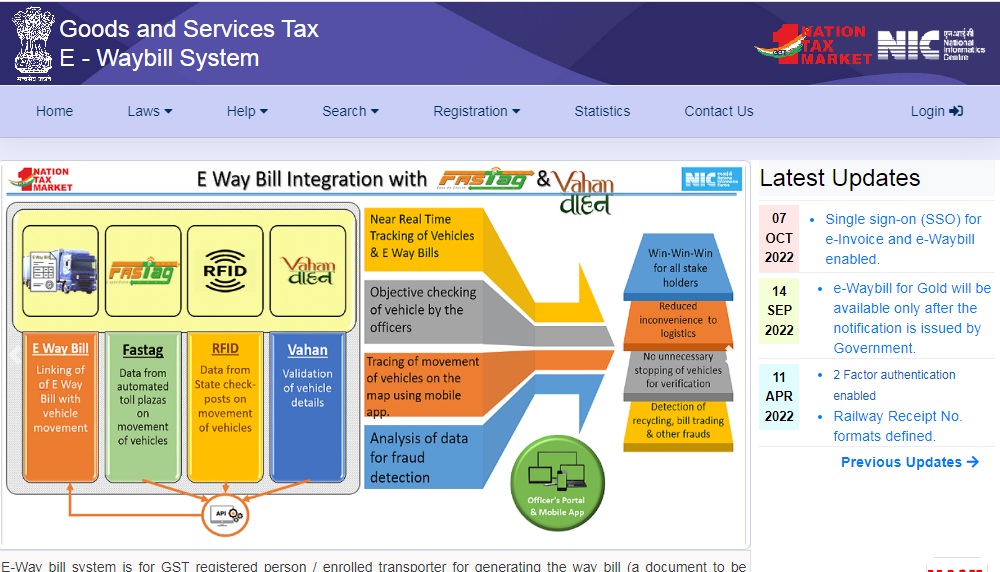

7) Electronic ewaybill system:

This link is provided to redirect to the e-way billing portal to generate an e-way bill for the movement of goods from one place to another. It came into effect for the interstate movement of goods on April 1, 2018. Also, it will be used for interstate cargo transportation in all states of India.

Electronic Billing Portal

On the other hand, there are more activities available to the taxpayer after logging into the GST portal, which are only available upon acceptance of the GST registration application.

Facilities available after logging into GST Portal

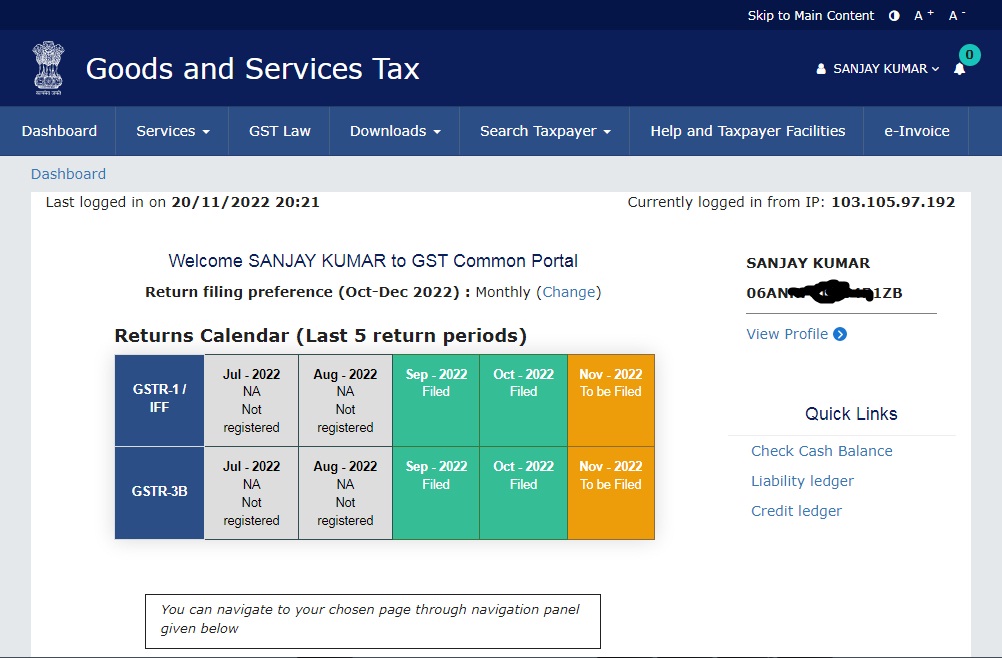

Dashboard at www.gst.gov.in

Quick links are available on the dashboard, such as viewing notifications and orders. In addition, you can view your personal data and check the balance of the liability register and ledger. Here is a screenshot of the dashboard.

Dashboard

Services available at www.gst.gov.in

Below additional services are available after login at www.gst.gov.in

1. Registration Services:

Amendment of Registration Core Fields

Amendment of Registration Non–Core Fields

Application to Opt for Composition Levy

Application for Withdrawal from Composition Levy

Stock intimation for opting for Composition Levy

Application for Cancellation of Registration

2. Ledger Services:

Cash Ledger

Credit Ledger

Liability Register

Payment towards demand

3. Returns

Returns Dashboard

Track Return Status

View e-Filed Returns

ITC Forms

Transition Forms

4. User Services

My Saved Applications

My Applications

View/Download Certificates

View Notices and Orders

View My Submissions

Feedback

Grievance / Complaints

Furnish Letter of Undertaking (LUT)

View My Submitted LUTs

Engage / Disengage GST Practitioner (GSTP)

ITC02-Pending for action

View Additional Notices/Orders

5. Refunds

Application for Refund

My Saved/Filed Applications

Track Application Status

6. Downloads

GST Billing and Account Software: To download Free GST billing software navigate to Downloads > Accounting and Billing Software option. you can view this download option only after login into the GST portal.

Recent New functionalities

1. Form GST REG – 14: This Registration Amendment form facility is available now for UN bodies, embassies, and other notified persons. With the help of this facility, they can make changes in core fields on the GST portal.

2. Form GST APL – 01: The Taxpayer can now file an appeal to the first appellate authority against any decision or order passed against him. Also, he needs to apply this online on the GST portal.

3. GSTR 2A Return The GSTR 2A is now available to download in Excel format. Therefore taxpayers can now reconcile their input tax credit availed with that uploaded by the respective suppliers on the GST portal. Earlier it was available in JSON format only.

4. Final Return in Form 10 Return is available on the portal now. The taxpayer needs to file this return within three months from the date of cancellation of registration.

5. GSTR 4 Online submission Online Submission and creation of form GSTR 4 are now available on the GST portal. In, the case of nil liability, taxpayers will not have to fill up any information and can file a nil return.

6.De linking of Various Returns De-linking of Form GSTR 6 with Form GSTR 1 & 5 is now available. Invoices will get auto-populate in GSTR 6A return on a real-time basis. Also, the same changes are applicable to GSTR 5. On the other hand, one can also download the latest offline utility for these changes.

7. Selection of GST practitioner The taxpayer can now select a “GST practitioner” to prepare an appeal in form APL-01. This is applicable if the taxpayer wants to file an appeal.

8. Appeal Against advance ruling If the taxpayer is not happy with the decision given by the advance ruling authority(AAR), then now he can file an appeal against such authority.

9. Request for Rectification of mistakes by AAR Yes, now you can send an online request to correct any mistakes in the rulings by an Advance authority.

10. Reply to Show cause notice(SCN) Now you can reply to show cause notice If you receive it for compulsory withdrawal from the composition scheme.

11. Annual GST Returns Annual Return GSTR 9, GSTR 9A, and GSTR 9C are now available on the GST portal. You may download GST offline tools in Excel from this page.

12. Changes in April 2020 The GSTN has made Changes in the Registration Form for TCS Taxpayers and alerts for the composition scheme.

GST Portal FAQs

What is the GST Portal?

GST Portal is an online Goods and Services Tax website provided by the Government of India. Millions of Indian taxpayers use GST Portal to perform various GST related activities online.

How can I check my GST status?

If you are newly registered for GST in India, then you can check your GST registration status by following the GST pre-registration steps.

However, if you are already registered and would like to know the current status of your GST number, please see our GST number search article.

How to log into GST with TRN?

See our article ‘How to log in with a Temporary Reference Number (TRN)’ to learn how to log in to GST using a TRN.

Can we use ARN number instead of GST?

Do not. An ARN number is a temporary code generated when registering for GST. Therefore, the ARN number will only be used to check the status of your GST registration application.