How to link PAN To Aadhar Card ? It Will Inactive If Not Linked! Penalty And Other Details Here

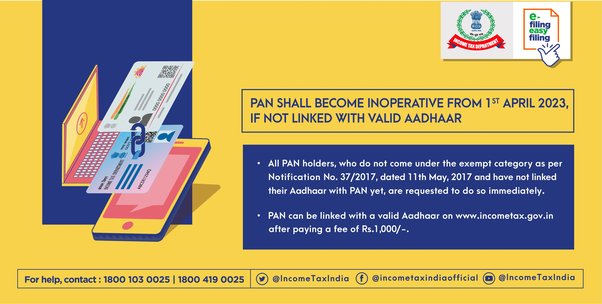

Category:UncategorizedA new rule introduced by the Central Direct Tax Board (CBDT) states that if the cardholder’s Permanent Account Number (PAN) is not associated with the Aadhaar card by the deadline (i.e. March 2020), it will be invalid after March 2023. will be 2023.

This deadline has already been extended and will not be extended further by the Income Tax Department. Failure to link the PAN card to the Aadhaar card by the deadline will result in a fine of Rs 1,000. In such cases, if the cardholder does not link it, he can use his PAN card until it expires. It was also announced by the official Twitter handle of Income Tax India on 18 November 2022. The tweet said, “According to the Income Tax Act, 1961, the last date to associate PAN with Aadhaar is March 31, 2023 for all PAN holders who do not fall under the exempt category.

To avoid delays and confusion, it is important to note a few minor points about how the process of linking PAN and Aadhaar works.

The PAN name, date of birth and gender are verified against the Aadhaar details in the UIDAI (Aadhaar) database.

Check date of birth on pan card and aadhar card also.

As per their UIDAI circular File No. K-11022/631/2017-UIDAI (Authentication-II) dated 27th November 2017, partial matching is not permitted. So please consider entering your data as per PAN and Aadhaar card.

Once the match is done, the system will send its OTP to the mobile number linked with Aadhaar.

After the OTP step is successful, Aadhaar and PAN are linked.

Make sure that the ‘Aadhaar Number’ and ‘Name per Aadhaar’ are exactly the same as printed on the original Aadhaar card.

If there are discrepancies between PAN data and Aadhaar data, it is recommended to rectify the same before linking them. Please also note that the data correction process for Aadhaar and PAN card may take several weeks. We recommend doing this as early as possible to avoid delays in filing your Income Tax Return.

our comments

We found that taxpayers with long names were truncated in non-standard format while issuing PAN, but not in the case of Aadhaar issue. So please link Aadhaar with PAN so that the linking can be successful. It is very important to link PAN before application. Your tax

How to link PAN and Aadhaar

There are three ways to link your PAN number with your Aadhaar number. The SMS method is easier, but sometimes there are problems with registering a request. That’s why I recommend the easy method #1 without logging into the portal.

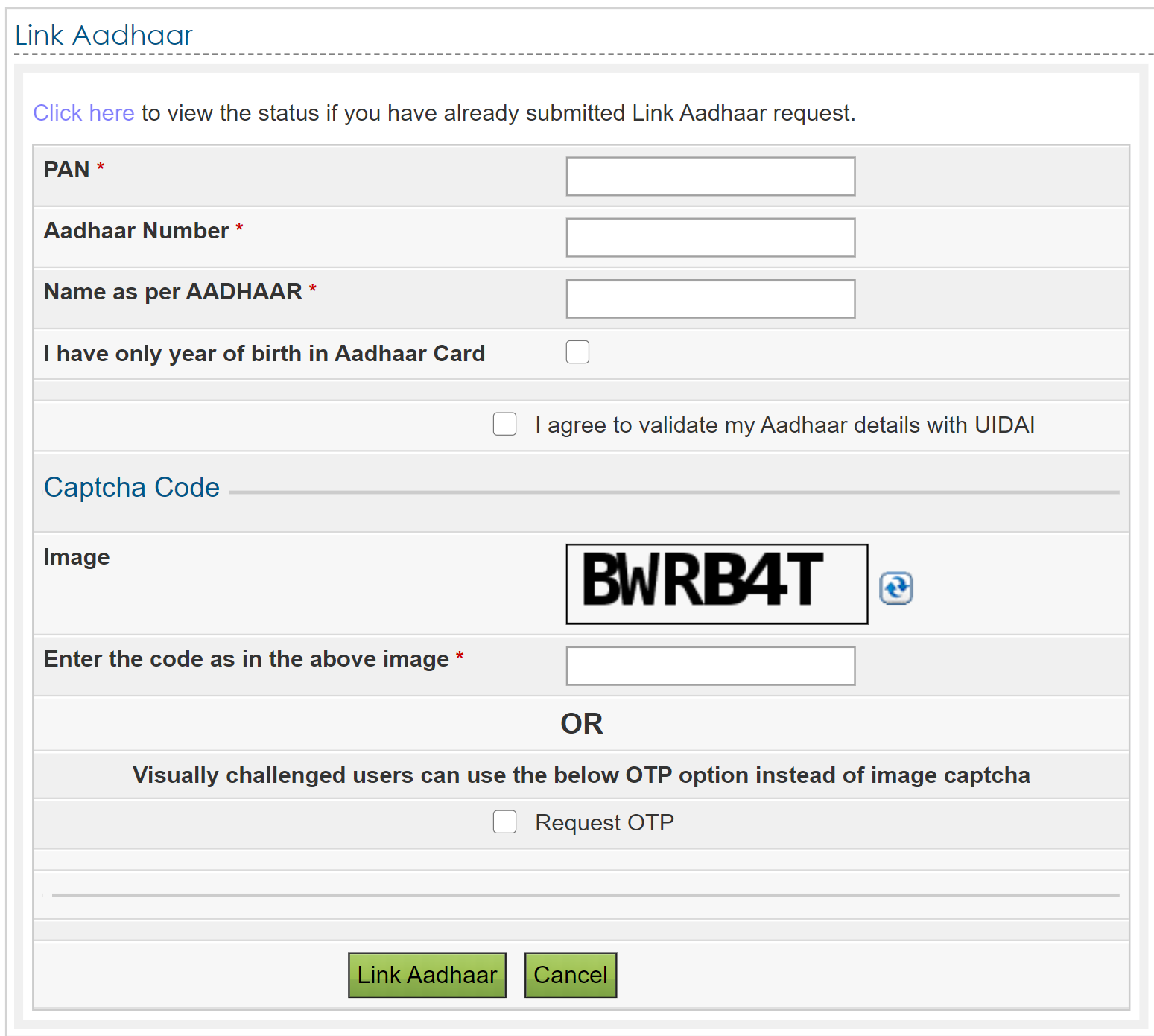

1. Link PAN and Aadhaar without logging into Income Tax Portal

Please enter your PAN number

Please enter your Aadhaar number

Enter name as per Aadhaar card

Check whether Aadhaar card shows date of birth only and not date of birth.

Check “I agree to verify Aadhaar details with UIDAI”

Enter the captcha as per the image. If you do not know the letters, click the Refresh button next to the field to get a new captcha.

To link, press the “Link Aadhaar” button.

That’s all! Once you have successfully linked your Aadhaar with your PAN number, you are ready to file your taxes electronically.

link aadhaar with pan card

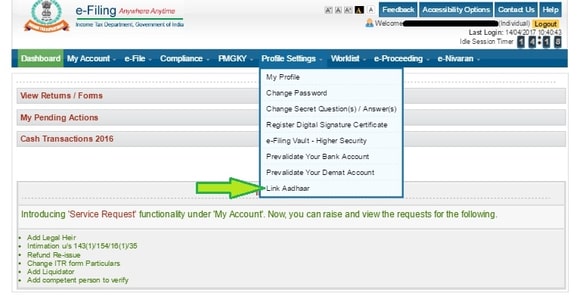

2. Login to ITD Portal

You can also link your PAN card with your Aadhaar card by logging in to the ITD portal. There is no major change between Method #1 above and this one, but the PAN number is automatically populated from your profile.

Visit ITD Electronic Filing Portal

Click on the “Login here” button in the top right

login to the portal

Go to the Profile Settings menu and click on the Link Aadhaar option. (view image)

Please enter your Aadhaar number

Enter name as per Aadhaar card

To link, press the “Link Aadhaar” button.

That’s all! Once you have successfully linked your Aadhaar with your PAN number, you are ready to file your taxes electronically.

Link Aadhaar with PAN Card after login

3. By sending SMS to NSDL

Another easy way to link your PAN card with your Aadhaar card is through the SMS method. This method works only if the name and date of birth are same in both PAN and Aadhaar.

Send SMS string in specific format to 567678 or 56161

The format of the string is:

UIDPN <space> <12 digit Aadhaar number> <space> <10 digit PAN number>

Example: SMS UIDPAN 123456789012 AAAPA1234A to 567678

123456789012 is the Aadhaar number, AAAPA1234A is the PAN number and 567678 is the location to send the SMS.

A confirmation message will appear whether you are connected or not.

That’s all! To link Aadhaar with PAN number using SMS method. If successful, you are ready to file your taxes electronically.

important

Note the space between “UIDPAN”, “Aadhaar Number” and “PAN Number”.

Requests should be sent from the mobile number linked to your Aadhaar number