GST Registration in Dwarka

Category:GST,GST News,GST Portal,gst registration,UncategorizedGST Registration in Dwarka

The Goods and Services Tax (GST) is a comprehensive tax that replaced multiple indirect taxes in India. Under the GST regime, all businesses with an annual turnover of more than Rs. 20 lakhs (or Rs. 10 lakhs for businesses in certain special category states) are required to register for GST. In this article, we will guide you through the process of GST registration in Dwarka.

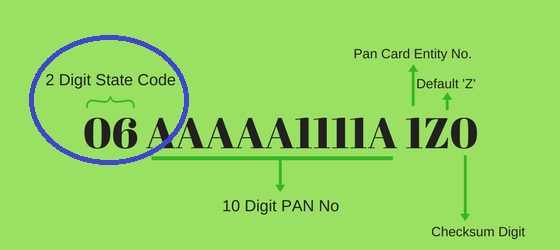

GST registration is a process through which businesses can obtain a unique Goods and Services Tax Identification Number (GSTIN) from the government. This number is essential for businesses to comply with the GST regulations and file their returns. The GST registration process is online and can be done through the GST portal. Here are the steps to follow for GST registration:

Step 1: Visit the GST portal and click on the “Register Now” button.

To begin the GST registration process, you need to visit the GST portal, which is https://www.gst.gov.in/. Once you are on the portal, click on the “Register Now” button to start the registration process.

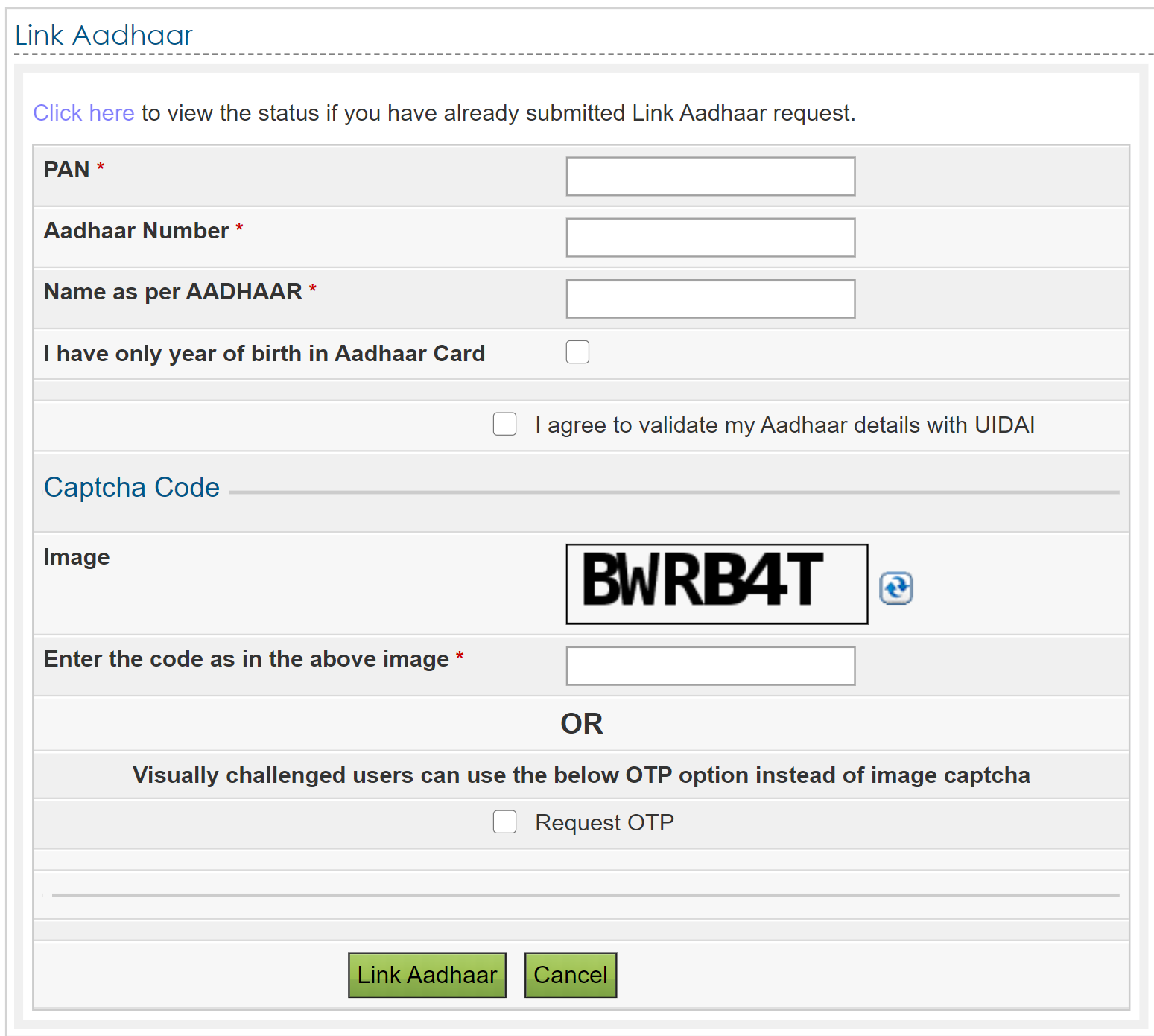

Step 2: Fill in the required details such as your name, PAN number, email address, and mobile number.

In the next step, you need to provide your personal and business details such as your name, PAN number, email address, and mobile number. You will receive an OTP on your mobile number and email address for verification.

Step 3: After successful verification, you will receive an Application Reference Number (ARN) on your email and mobile number.

Once your mobile number and email address are verified, you will receive an Application Reference Number (ARN) on your email and mobile number. You need to keep this number safe as it will be required for future reference.

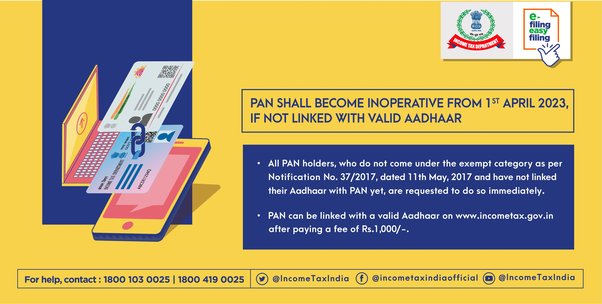

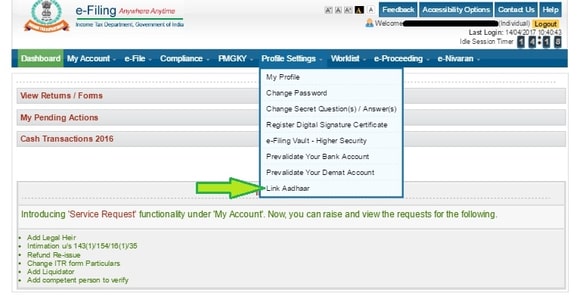

Step 4: You need to upload the required documents such as PAN card, Aadhaar card, bank statement, and address proof.

In this step, you need to upload the required documents such as your PAN card, Aadhaar card, bank statement, and address proof. These documents are necessary for the verification process, and you need to ensure that all the information is correct and up-to-date.

Step 5: Once the documents are verified, you will receive the GSTIN (Goods and Services Tax Identification Number) and the registration certificate.

After the documents are verified, you will receive the GSTIN and the registration certificate. The GSTIN is a unique 15-digit number that is used for all GST-related transactions. You can also download the registration certificate from the GST portal.

Documents Required for GST Registration in Dwarka:

To register for GST in Dwarka, businesses need to submit the following documents:

- PAN card of the business or individual

- Proof of business registration such as the partnership deed, company registration certificate, or LLP agreement.

- Identity and address proof of the authorized signatories such as Aadhaar card, PAN card, or passport.

- Bank account statement or a cancelled cheque.

- Address proof of the place of business such as rent agreement, electricity bill, or property tax receipt.

Benefits of GST Registration in Dwarka:

Here are some benefits of GST registration in Dwarka:

- Legally Compliant: GST registration is mandatory for businesses with an annual turnover of more than Rs. 20 lakhs. By registering for GST, businesses can ensure that they are legally compliant and avoid penalties and legal complications.

- Input Tax Credit: GST registration allows businesses to claim input tax credit on the taxes paid on their purchases. This can help reduce the overall tax liability and improve cash flow.

- Competitive Advantage: By registering for GST, businesses can compete with other businesses in the same industry that are also registered for GST. This can help improve the credibility of the business and attract more customers.

- Inter-state Trade: GST registration is mandatory for businesses engaged in inter-state trade. By registering for GST, businesses can comply with the regulations and avoid penalties and legal complications.

- Simplified Tax System: GST is a simplified tax system that replaces multiple indirect taxes such as VAT, Service Tax, and Central Excise. By registering for GST, businesses can simplify their tax compliance process and save time and money.

GST Filing in Dwarka:

GST filing is a process through which businesses report their tax liability to the government. Under the GST regime, businesses need to file three types of returns – GSTR-1, GSTR-2, and GSTR-3. GSTR-1 is a monthly return that businesses need to file to report their outward supplies. GSTR-2 is a monthly return that businesses need to file to report their inward supplies. GSTR-3 is a monthly return that businesses need to file to report their tax liability. Here are the steps to follow for GST filing in Dwarka:

Step 1: Visit the GST portal and log in using your credentials.

To file GST returns, you need to visit the GST portal and log in using your credentials.

Step 2: Go to the “Services” section and click on “Returns”.

In the next step, you need to go to the “Services” section and click on “Returns”.

Step 3: Select the relevant return and click on “Prepare Online”.

In this step, you need to select the relevant return (GSTR-1, GSTR-2, or GSTR-3) and click on “Prepare Online”.

Step 4: Fill in the required details such as your turnover, outward and inward supplies, and tax liability.

After selecting the relevant return, you need to fill in the required details such as your turnover, outward and inward supplies, and tax liability. You need to ensure that all the details are correct and accurate as any errors or discrepancies can lead to penalties and legal complications.

Step 5: Verify the details and submit the return.

After filling in all the required details, you need to verify the details and submit the return. You can do this by clicking on the “Preview” button and reviewing the details. Once you are satisfied with the information, click on the “Submit” button to file the return.

Step 6: Pay the tax liability (if applicable).

If you have a tax liability, you need to pay the tax through the GST portal using net banking or debit/credit card. You can also generate a challan and make the payment through an authorized bank.

Step 7: Download the filed return and keep it for future reference.

After filing the return, you need to download the filed return and keep it for future reference. You can download the filed return by clicking on the “Download” button on the dashboard.

Conclusion:

In conclusion, GST registration and filing are essential for businesses operating in Dwarka. The GST registration process is simple and can be done online through the GST portal. Once registered, businesses need to file their GST returns regularly to avoid penalties and legal complications. The GST filing process is also online and can be done through the GST portal. By following the steps mentioned in this article, businesses can easily register for GST and file their returns in Dwarka.