GST Registration Process for Aadhaar Authentication or EKYC for Existing Taxpayer

Category:aadhar authetication,due date,e-kyc,GST,gst registration,testing,UncategorizedAadhaar Authentication / e-KYC for existing taxpayers on the GST portal

GSTN issued a recommendation on January 21 for existing taxpayers to complete Aadhaar certification or e-KYC.

Aadhaar authentication and e-KYC features when Aadhaar is not available are available on GST Common Portal w.e.f. January 6, 2021 for current taxpayers.

A. Classes of taxpayers who can use the function:

1. Regular taxpayers (including accidental taxable persons, SEZ units / developers),

2. Input Service Distributor (ISD). And

3. Taxpayer

B. Under the taxpayer category that does not require Aadhaar certification or e-KYC-

1. Government sector,

2. Public sector business,

3. Local government; and

4. Legal institution

gst aadhaarekyc authentication

Aadhaar Authentication or EKYC Procedures for Existing Taxpayers

C. Aadhaar Certification or E-KYC-Introduction

This is the process of authenticating the Aadhaar details provided at the time of registration, and if the Aadhaar details are not provided, we will provide the details of other documents for the verification process.

a. If Aadhaar number is available:

Key authorized signers and owners / partners / directors / administrative partners / performers of registered entities can go to Aadhaar authentication

B. If Aadhaar number is not available:

Taxpayers can upload one of the following documents to receive the e-KYC

Aadhaar registration number

passport

EPIC (Vote ID Card)

KYC form

Certificate issued by the competent authority

Other

D. Aadhaar authentication / e-KYC completion procedure on the GSTN portal:

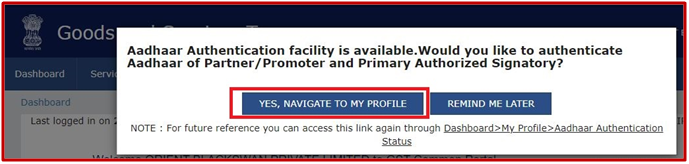

When an existing registered taxpayer logs on to the GSTN portal, they will see a pop-up asking “Are there two options available for partners / promoters?” “Yes, go to My Profile” to authenticate the primary approved signature base. I want to do it, “remind me later”.

Aadhaar certification

Clicking Notify Later will stop the pop-up and allow the user to go anywhere in the GST portal.

Click Yes, go to my profile and the system will go to my profile.

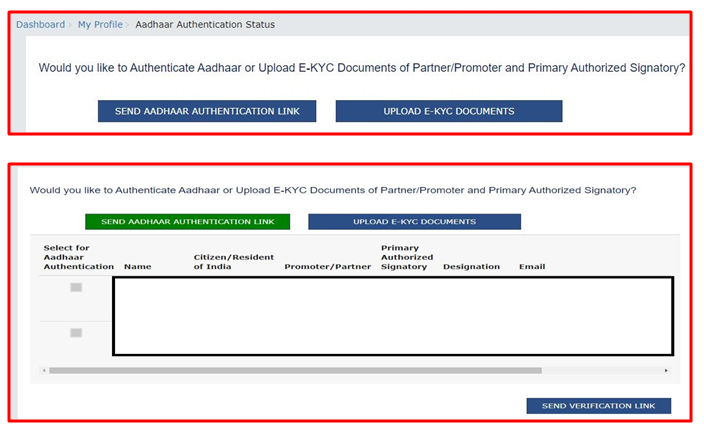

MY PROFILE will display a new tab “Aadhaar Authentication Status”. From this tab, a link for Aadhaar authentication will be sent to the primary approved signer and one of the promoters / partners he has selected. You need to enter the Aadhaar number. An SMS and email OTP will be sent for authentication.

Go one step ahead with GST Plus

One-stop solution for all GST related issues

Access tools that make working with GST much easier

Participate in weekly webins and podcasts

Analysis of the latest decisions and notifications at GST

If the same person is the primary approved signer and partner / spokesperson, Aadhaar certification is required only for that person.

Aadhaar authentication status

take care

In some cases, it is observed that the citizenship of the approved signer / promoter is set to “NO” by default. This means that you are not an Indian citizen and your Aadhaar validation will be disabled. If you notice in your case, take a screenshot and file a complaint on the GSTN portal (to fix the error).

On my profile page, in addition to submitting the Aadhaar AUTHENTICATION LINK, the taxpayer also sees the UPLOAD E-KYC DOCUMENTS option, from which I can upload the e-KYC document to the portal. In this case, the e-KYC certification process requires approval of the e-KYC document uploaded by the tax office.

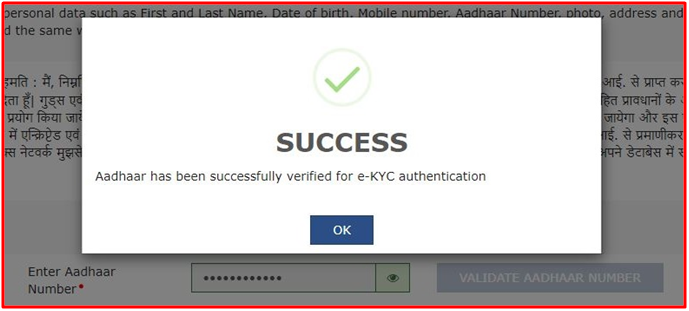

E. If Aadhaar or EKYC authentication is successful-

If the authentication is successful, a success message will be displayed on the screen.