GST Registration in Uttam Nagar

Category:gst registration,GSTGST registration in Uttam Nagar is the process by which taxpayers are registered under GST. When a business or company is officially registered, it is given a unique registration number called GSTIN (Goods and Services Tax Identification Number). A 15 digit number assigned by the central government after the taxpayer is registered for GST.

GST registration

Under the GST regime, any manufacturer or business with an annual turnover exceeding Rs. Rs 400,000 (Rs 10,000 for Hill States and North East States) will be registered as a regular taxable person. Some businesses are required to register under GST.

What are the benefits of his GST registration in Uttam Nagar, Delhi?

GST significantly enhances the Government’s ‘Made in India’ initiative by offering goods or services offered in India to international and domestic companies. In addition, all imported or shipped goods are deducted with Integrated Tax (IGST), which is roughly equivalent to state and central GST. This ensures equal taxation on social goods and imported goods.

Under GST administration, indirect taxes are created piecemeal within centers and states, resulting in zero tax rates on exports, unlike the current system where records for specific taxes are not cleared. All taxes on returned goods or services or all taxes paid on input services shall be prorated by the number of such exported products. The practice of exporting only the value of goods, not taxes, is realized. Increase settlement stability and boost Indian exports. By facilitating business in terms of cash flow, exporters are facilitated by allowing a temporary or interim refund of 90% of the application within 7 days of administration of acceptance of the application.

GST is expected to boost government taxation or revenue by expanding the tax base and improving taxpayer agreement. The GST is expected to boost India’s ranking in the Ease of Doing Business Index and is expected to increase GDP (gross domestic product) by 1.5% to 2%.

GST reduces tax prevalence by introducing a complete input tax credit system throughout the supply chain. Streamline your business or corporate operations by seamlessly making available the input tax credits behind the goods or services at each stage of supply.

A uniform GST rate will reduce the grounds for fraud by reducing rate arbitrage between adjacent states, interstate and interstate transactions.

Common techniques for taxpayer registration, tax returns, a common tax base, a uniform tax return format, time frames for each activity, and a common system for the provision of goods and services shall define the taxation system. Stronger support.

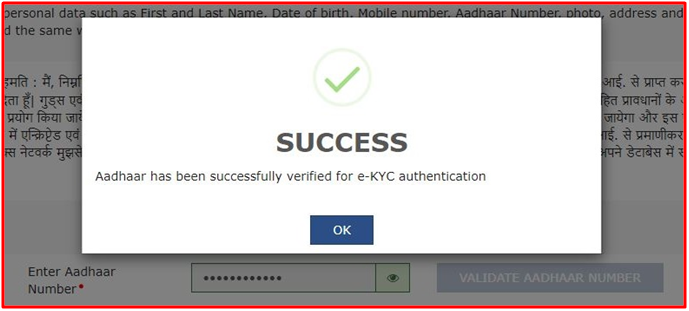

All methods of applying for registration, paying taxes, filing returns, and filing returns are done online through the GSTN. Validation of input tax credits is done online.

GST Registration Checklist Requirements

The new GST registration is open to all suppliers who maintain a business or company across India.

GST registration is mandatory for all organizations or businesses, small start-ups, businesses and entrepreneurs exceeding selected turnover limits in India.

Must be registered under the GST Act to encourage single tax filing rules.

A prescribed record or document and data relating to all required fields of the registration application.

location or place of business.

A resident or citizen of India and duly signatory with basic details including PAN card details.

In addition, Director/Owner/Karta/Trustee/Member with relevant PAN card.

Indian Financial System Code (IFSC) same branch number

Who should register for her GST?

A person whose business or company turnover in a fiscal year exceeds her Rs.200,000.

If the turnover covers only her supply of non-GST goods or services.

To see this limit, sales must include the sum of all paid supplies, exempt supplies, goods and services transactions, and interstate supplies for persons with the same permanent account number.

If a registered company is transferred, the transferee shall be registered from the date of the change.

A person who makes an interstate supply of goods or services.

Non-Resident Taxable Person

casual taxable person

Those who pay tax under the reverse charge system

supplier agent

input service distributor

eCommerce Executive or Aggregator

Persons providing access or search assistance to online reports and databases to persons in India other than accredited taxable persons from locations outside India

Important features to consider when doing her GST registration for an individual

Here are some key points when registering for GST for her as an individual:

Initially, the GST law states that any business or individual with an annual turnover exceeding INR 200,000 must be registered for GST. This limit was kept at he 1 lakh rupees for certain category requirements. However, from 1 April 2019, this objective was raised to Rs 4 lakh for sale and purchase of goods.