GST Registration in Mayapuri

Category:gst registration,GSTGST registration in Mayapuri is the process by which taxpayers are registered under GST. When a business or company is officially registered, it is given a unique registration number called GSTIN (Goods and Services Tax Identification Number). A 15 digit number assigned by the central government after the taxpayer is registered for GST. Any Indivisual and Businesses can Apply online for a new GST registration number in delhi and receive your certificate in just 7 business days. For More support contact here

GST registration

GST full name is Goods and Services Tax. In Hindi it is called “वस्तु एवं सेवा कर”.

Under the GST regime, any manufacturer or business with an annual turnover exceeding Rs. Rs 400,000 (Rs 10,000 for Hill States and North East States) will be registered as a regular taxable person. Some businesses are required to register under GST.

Types of GST registration

• Normal taxpayers

Most businesses in India fall under this category.

Businesses whose turnover exceeds Rs 40 lakh in a financial year are required to register as normal taxable people. However, the threshold limit is Rs 10 lakh if you have a business in the north-eastern states, J&K, Himachal Pradesh, and Uttarakhand.

• Casual taxable individual

Occasional or seasonal businesses need to register their businesses under GST for this category. Businesses need to make a deposit equal to the GST liability from the occasional operations.

The tenure for registration is 3 months. However, businesses can apply for renewal and extensions.

• Non-resident taxable individual

Individuals who reside outside India but occasionally supply goods or services as agents, principals, or in other capacities to Indian residents are liable to file for registration under this category.

The business owner must pay a deposit equal to the expected GST liability during the GST active tenure. The normal tenure is 3 months. However, individuals can extend or renew the registration if required.

• Composition registration

Businesses with an annual turnover of up to Rs 1 crore are eligible for registration under composition scheme. Under this scheme, businesses have to pay a fixed amount of GST irrespective of their actual turnover.

What are the benefits of GST registration in Mayapuri, Delhi?

India’s current tax structure is very complex. According to the Indian constitution, the state government mainly has the right to impose taxes on the sale of goods and the right to levy taxes on the production and services of goods.

Due to this, different types of taxes are applicable in the country, due to which the current tax system of the country is very complex. It is difficult for companies and small businesses to follow different types of tax laws.

GST significantly enhances the Government’s ‘Made in India’ initiative by offering goods or services offered in India to international and domestic companies. In addition, all imported or shipped goods are deducted with Integrated Tax (IGST), which is roughly equivalent to state and central GST. This ensures equal taxation on social goods and imported goods.

Under GST administration, indirect taxes are created piecemeal within centers and states, resulting in zero tax rates on exports, unlike the current system where records for specific taxes are not cleared. All taxes on returned goods or services or all taxes paid on input services shall be prorated by the number of such exported products. The practice of exporting only the value of goods, not taxes, is realized. Increase settlement stability and boost Indian exports. By facilitating business in terms of cash flow, exporters are facilitated by allowing a temporary or interim refund of 90% of the application within 7 days of administration of acceptance of the application.

GST is expected to boost government taxation or revenue by expanding the tax base and improving taxpayer agreement. The GST is expected to boost India’s ranking in the Ease of Doing Business Index and is expected to increase GDP (gross domestic product) by 1.5% to 2%.

GST reduces tax prevalence by introducing a complete input tax credit system throughout the supply chain. Streamline your business or corporate operations by seamlessly making available the input tax credits behind the goods or services at each stage of supply.

A uniform GST rate will reduce the grounds for fraud by reducing rate arbitrage between adjacent states, interstate and interstate transactions.

Common techniques for taxpayer registration, tax returns, a common tax base, a uniform tax return format, time frames for each activity, and a common system for the provision of goods and services shall define the taxation system. Stronger support.

All methods of applying for registration, paying taxes, filing returns, and filing returns are done online through the GSTN. Validation of input tax credits is done online.

GST Registration Checklist Requirements

The new GST registration is open to all suppliers who maintain a business or company across India.

GST registration is mandatory for all organizations or businesses, small start-ups, businesses and entrepreneurs exceeding selected turnover limits in India.

Must be registered under the GST Act to encourage single tax filing rules.

A prescribed record or document and data relating to all required fields of the registration application.

location or place of business.

A resident or citizen of India and duly signatory with basic details including PAN card details.

In addition, Director/Owner/Karta/Trustee/Member with relevant PAN card.

Indian Financial System Code (IFSC) same branch number

There are many benefits of GST registration, which include:

1. Stronger Than Competitors – GST registration provides a valid business registration so you can easily show proof of legitimacy to other businesses and individuals.

2. Get Input Tax Credit – GST registered holders can use Input Tax Credit while purchasing goods or services. So, if you are a B2B business, you need to register for GST from the very beginning.

3. Sell Anywhere in India – GST registered holders can sell their products or services anywhere in India. Hence, there is no limit like VAT/CST. You can easily send goods interstate.

4. Open a Checking Account – GSTIN holders can easily open a checking account on the basis of their GST Registration Certificate.

5. Online selling – If you want to go e-commerce, you can easily sell through e-commerce portals like Amazon and Flipkart based on your GSTIN registration number.

6. Government Project Tenders – If you are a contractor and want to apply for any type of government tender, all government projects require only a valid company with GST number.

7. Accept large projects from MNCs – MNCs will not do this unless they are legitimate businesses with valid proof of business.

8. Build Confidence Among Customers – Issuing a valid GSTIN tax invoice will build trust among customers and enhance brand value.

Who should register for GST?

A person whose business or company turnover in a fiscal year exceeds her Rs.200,000.

If the turnover covers only her supply of non-GST goods or services.

To see this limit, sales must include the sum of all paid supplies, exempt supplies, goods and services transactions, and interstate supplies for persons with the same permanent account number.

If a registered company is transferred, the transferee shall be registered from the date of the change.

A person who makes an interstate supply of goods or services.

Non-Resident Taxable Person

casual taxable person

Those who pay tax under the reverse charge system

supplier agent

input service distributor

eCommerce Executive or Aggregator

Persons providing access or search assistance to online reports and databases to persons in India other than accredited taxable persons from locations outside India

Important features to consider when doing her GST registration for an individual

Here are some key points when registering for GST for her as an individual:

Initially, the GST law states that any business or individual with an annual turnover exceeding INR 200,000 must be registered for GST. This limit was kept at he 1 lakh rupees for certain category requirements. However, from 1 April 2019, this objective was raised to Rs 4 lakh for sale and purchase of goods.

What is GST Registration Process

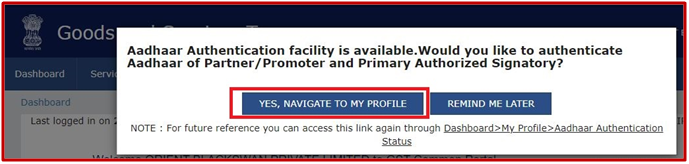

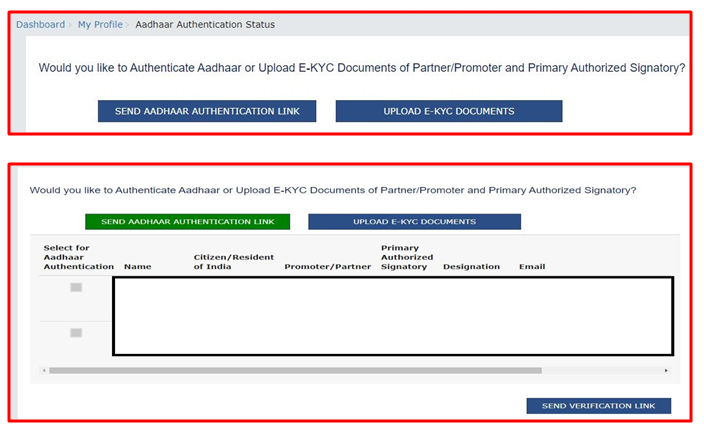

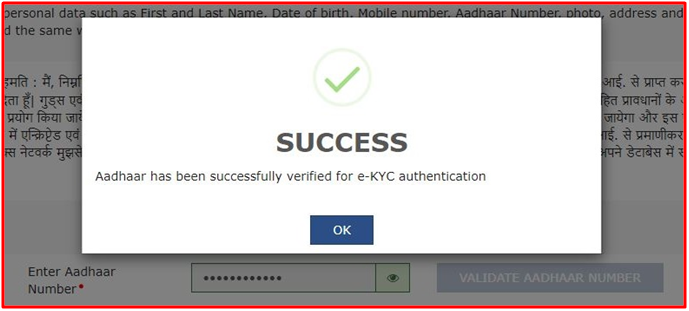

GST Registration is available on the GST Portal. You need to apply for GST registration on the GST portal with the form REG-01.

However, GSTPROFITS’s GST registration service can help you register your business for GST and get the GSTIN.

A well defined GST specialist will explain the applicability and compliance of GST on your business and register your business for GST.

Documents Required for GST Registration

PAN of the applicant

Aadhar card

Business Registration Certificate or Company Registration Certificate

Proof of Identity and Address of the Promoter/Director with photo

Proof of business address

Bank statement / canceled check

electronic signature

Power of Attorney/Board Resolution of Approved Signatories

What is compliance after GST registration?

After GST registration, every assessee has to submit GST return on compliance basis. If you are registered under the regular scheme of GST then you will have to submit the same monthly return. Constituent traders are required to make quarterly deposits under certain conditions. You can get all the information about GST return declarations here.

GST Registration Fee

GST registration is a tedious 11-step process of submitting multiple business details and scanning documents. There is no charge under the GST Act to get your GST registration through the GST Portal, but you can save a lot of time and effort by purchasing the GST Registration Scheme through GSTPROFITS. You can choose to vacate the GST registration service in delhi. A GST expert will assist you in completing your GST registration.