Category:Uncategorized

Everything You Need to Know About the MGNREGA Online Grievance Process

Everything You Need to Know About Online Complaint Procedures Related to MGNREGA

MNREGA-Related Online Complaints

In a country like India, the MNREGA scheme is like a boon to the poor. Help rural people fight unemployment. It aims to serve approximately 52 million people and provide a livelihood for their families. Read this blog to learn more about MGNREGA and how the online grievance process related to MGNREGA works.

Introduction of MNREGA

MGNREGA stands for Mahatma Gandhi National Rural Employment Guarantee Act, 2005. Formerly known as NREGA. The Ministry of Rural Development (MoRD) administers this program. The purpose of this scheme is to improve livelihoods in rural areas. The scheme guarantees a minimum of 100 days of wage employment per year.

History: Who started MNREGA?

The NREGA Act was passed on August 23, 2005 under his UPA government. The face of the government was Prime Minister Manmohan Singh. It came into effect in 2006.

In 1991, this law was first introduced by his P.V. Narasimha Rao government as a pilot project. This evolved into his MGNREGA in the early 2000s.

In 2009, the law was amended to change the nomenclature. NREGA became MNREGA.

The legislation’s primary objectives are to improve food security, build infrastructure, and find employment for agricultural workers during the off-season.

Some of the purposes of MGNREGA are:

This aims to secure a rural livelihood by providing him with 100 days of wage employment in the fiscal year.

It has enhanced livelihoods and provided resources to the poor.

Her third of employment is guaranteed to women.

She created productive assets such as roads, ponds, canals and wells.

MNREGA Achievements

It is the largest social welfare system in the world. In his first ten years of this scheme he spent Rs 3.14 crore.

According to the MoRD report, MGNREGA is committed to revitalizing the local ecosystem. This has many implications for local employment. For example, her MNREGA in Karnataka benefited 56.87 million people by providing jobs in 2020-2021.

The central government has spent his 5 billion rupees on her MNREGA scheme over the past eight years.

It helped rural women earn a living. It also helped me get social security.

It has improved the lives of Scheduled Tribes (ST) and Scheduled Castes (SC). It has also reduced poverty levels.

We support job changes from salaried workers to full-time employees.

In India, where malnutrition is a major health problem, some states spend half of her MGNREGA income on food and nutrition.

The main principles of MGNREGA are:

This guarantees a minimum of 100 days of wage employment in the fiscal year.

33% of bookings are for women.

MNREGA job card

The MNREGA scheme provides employment to the poor and employment cards are in place to record this. This card will be issued to every family whose member has requested work under her MNREGA. Each cardholder is entitled to 100 days of unskilled labor.

Benefits of the MNREGA Job Card

You can find more information about jobs in the MNREGA scheme.

She offers 100 days of employment to minors with no source of income.

Helps track benefits given by the government.

Role of Gram Panchayat in MNREGA

Prepare an annual report for the scheme.

Receive and review job applications.

Gram Panchayat registers all families.

Work will be assigned within 15 days of submission of the application.

MGNREGA job card credit.

The agency holds a hiring day in all wards once a month.

Role of gram mackerel in MNREGA

Monitor performance with the help of Gram Panchayat.

List tasks according to priority.

Resolve all queries for workers related to MNREGA.

Role of State Governments in MNREGA

State governments make up the State Job Guarantee Council.

Provides a framework for state regulation under the MGNREGA Act.

Established the State Employment Guarantee Fund (SEGF).

This will ensure that her POs and staff at State, District and Glampanchayat levels are dedicated to implementing the plan.

Register your MNREGA complaint online

If you apply for the system and don’t get a job, you can complain. Also, this situation is if you do not receive a salary. Online complaints are useful in the current scenario. Complaints can be drafted at your convenience. From registering complaints to checking the status of complaints, it is possible with just one click. No need to rush.

Why do people choose to file complaints online?

Today, people are choosing to register their complaints digitally. The internet has given them a voice to complain about. Earlier people complained about physical concerns. After many attempts he could not find a solution. However, this does not apply to online complaints.

Who can file a complaint about his MGNREGA?

Anyone who has been challenged by MNREGA authorities may file a complaint. Complaints can be submitted in person or through their representatives.

How do I file a complaint with MGNREGA?

In the Complainant Details and Location section, enter the following:

I will write about the identity of the petitioner.

From the dropdown box, select the source of the complaint as follows:

emails, newsletters, etc.

Select province, district, block, panchayat.

After this, enter the complainant’s name, father’s or husband’s name, address, and email ID.

Enter your phone or mobile number in the dialog box.

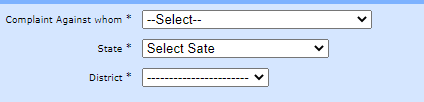

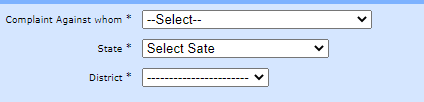

In the next Complaint Description and Location section, enter the following:

Select the entity you are complaining about, such as a district

Panchayat, Gram Panchayat, etc.

Select a state.

Select a district.

MNREGA Complaint

After this, another complaint category will appear. Select the reason for your complaint from these drop-down boxes. Please include the date of the complaint and the date of the incident.

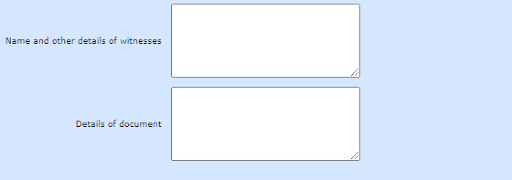

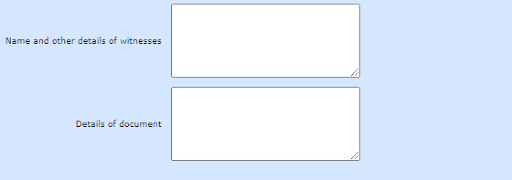

Finally, under the “Evidence submitted by the complainant to prove the complaint” section, you must share the name of the witness and other details and documentary details. Once you have filled out all the sections carefully, click Save Complaint.

Evidence submitted by the complainant

When should she file an MNREGA complaint?

You should file a complaint if:

The scheme provides equal working opportunities regardless of gender or caste. If you face discrimination based on caste or gender, you can file a complaint.

Everyone should have access to clean water. MGNREGA is responding to this need by rebuilding ponds and wells. According to reports, 600,000 of her children under the age of five die each year due to inadequate water supplies and poor sanitation. If you have trouble getting clean water, you can complain.

MGNREGA focuses on wastewater programs. In Tamil Nadu, efforts were made to remove bushes and grasses from waterways and improve drainage.

Similarly, MNREGA has many problems. These are:

job card

payment

measurement

looking for a job

distribution of work

task management

unemployment benefits

How to check MNREGA complaint status

After registering a complaint, you may want to know its status. You can check the status by clicking on the official site. Enter your Complaint ID here to continue.

While registering online complaints related to MGNREGA, you may come across the word Lokpal somewhere. representative group. It deals with complaints from the public against governments or organizations such as banks and insurance companies.

The MGNREGA Ombudsman was created under Section 27 of the MGNREGA Act. Its main purpose is to establish a system that can represent the public.

Union Rural Development and Panchayati Raj Minister Giriraj Singh has launched his Lokpal app to facilitate grievances. This app helps governments maintain transparency.

Some frequently asked questions

MNREGA is he BPL only?

No, MGNREGA is not just for BPL. Now, this scheme is for everyone in rural India.A person’s age must be 18 years old.

Is MGNREGA a Central Support Scheme or a Central Sector Scheme?

Central Sponsor Scheme and Central Sector Scheme are different terms. Such schemes implemented by state governments and sponsored by the central government are called centrally sponsored schemes. However, the central government implements and funds the central sector scheme. MGNREGA is a centrally sponsored scheme.